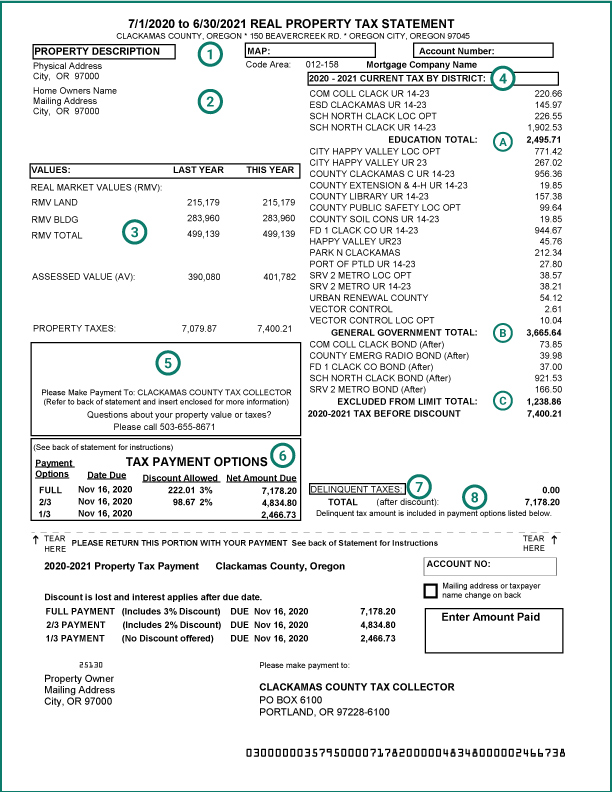

- Property data

- Ownership and mailing address

- Real Market and Assessed (taxable) Property Value

- Taxing districts

- Yellow or green statement?

- Payment options and due dates

- Delinquent taxes

- Total taxes due (after discount)

What Your Statement Means

- Property data

Property address, legal description and account number. - Ownership and mailing address

If the mailing address on your statement is incorrect or has changed, check the box on the front of your payment stub and write the correct address on the back or contact our office. It is the property owner's responsibility to inform the Assessor of any address changes. - Real Market and Assessed (taxable) Property Value

Real Market Value (RMV) is the county assessor’s estimate of the market value of your property as of Jan. 1, of the current year. Under Measure 50,

Assessed Value is the lower of the RMV and Maximum Assessed Value (MAV). Learn more about RMV, MAV and AV. - Taxing districts

Your tax statement shows the taxes imposed for each of the districts where your property is located. Each district collects a permanent tax rate for ongoing services, plus any voter-approved taxes. Measure 5 requires levies to fall into three categories:- Education taxes

- General government taxes

- Bond taxes authorized by voters

- Yellow or green statement?

If your tax statement is yellow...

Receiving a yellow tax statement means a lender requested information and may pay your property tax. Call your lender if you have any questions about who is responsible for payment. Please keep this statement for your records and do not pay with this statement if your lender pays your property taxes.

If you receive a green statement...

Receiving a green tax statement means a lender did not request information to pay your property taxes. Call your lender if you think they are responsible to pay. Please keep this statement for your records. Pay taxes by Nov. 15 to receive a discount and avoid interest. - Payment options and due dates

- Delinquent taxes

The amount of tax and interest owed from previous years. Taxes identified with an asterisk (*) may result in property foreclosure if not paid. Payments will be applied to the oldest tax year first. - Total taxes due (after discount)

Please return the lower portion of your tax bill(s) with your payment and use the enclosed envelope with the appropriate postage. Write your account number(s) on the front of your check to ensure proper credit. Your cancelled check is your receipt. The upper portion of the tax statement should be kept for your records.

- Payment for property taxes must be credited to the earliest year for which the taxes are due on the property for which the payment is being made.

- The due date for property tax payments is Nov. 15. If the 15th is a weekend or holiday, it will be the next business day.

- Please mail early to ensure you receive your discount and avoid interest.

Translate

Translate