Property taxes are due Nov. 15, 2023

Discounts and payment options available

Ways to Pay

Drop box

- A walk-up payment drop box is located outside our building entrance at 150 Beavercreek Road in Oregon City

- A temporary drive-up drop box will be located in the north parking lot from

Nov. 1-15 - Check our website for updates to drive-up drop box options

Online

- Visit our website to pay by credit card, debit card, or e-check (Clackamas County retains no portion of processing fees)

- Payments must be submitted on or before the due date

- Allow sufficient time for bank processing so your funds arrive by Nov. 15

- Bill pay remittance needs to be in our office by the due date if not postmarked

- Mail your check (do not mail cash) using the return envelope and include

your payment stub - Make checks payable to Clackamas County Tax Collector

- Payments must be USPS postmarked by Nov. 15, 2023 with proper postage

- Please mail early to ensure your payment is received timely

- Returned checks will be charged a $25 service fee

In person*

- Regular office hours are Monday–Thursday from 8 a.m. to 4 p.m.

- Check our website for expanded office hours during tax season

Discounts and Payment Options

Payments must be submitted on or before the following due dates. Late payments will not receive a discount and may incur interest.

Option 1: Pay full amount by 11/15/2023 for a 3% discount

Option 2: Pay 2/3 by 11/15/2023 for a 2% discount and the remaining 1/3 by 5/15/2024

Option 3: Pay 1/3 by 11/15/2023, 1/3 by 2/15/2024 and 1/3 by 5/15/2024

Paperless Property Tax Statements Now Available

Clackamas County now offers an option for property tax statements to be delivered electronically through a new service called eNoticesOnline. Property owners who want to go paperless and/or prefer to receive documents online, rather than printed and mailed, can now sign up for the new electronic statement service using a unique account registration code printed on their property tax statements. Once an account is registered, electronic statement notices will arrive via a registrant’s email and paper statements will no longer be delivered.

Clackamas County now offers an option for property tax statements to be delivered electronically through a new service called eNoticesOnline. Property owners who want to go paperless and/or prefer to receive documents online, rather than printed and mailed, can now sign up for the new electronic statement service using a unique account registration code printed on their property tax statements. Once an account is registered, electronic statement notices will arrive via a registrant’s email and paper statements will no longer be delivered.

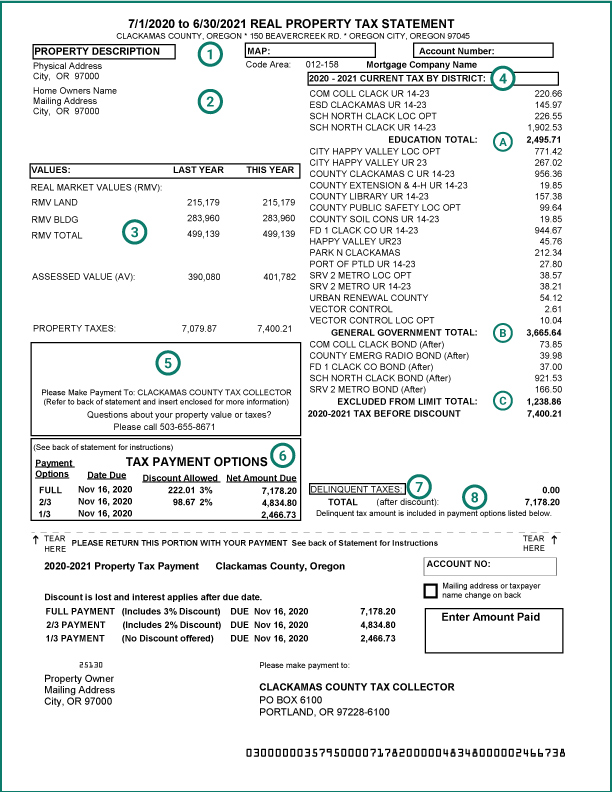

Understanding Your Tax Statement

- Key property data

- Ownership and mailing address

- Real Market and Assessed (taxable) Property Values (current and prior year)

- Taxing districts

- Education taxes

- General government taxes

- Bond taxes

- A yellow tax statement means your mortgage lender requested your payment information and may be paying your property tax

- Payment options and due dates

- Delinquent taxes

- Total taxes due (after discount)

Board of Property Tax Appeals (BOPTA)

If you have questions regarding the values on your tax statement, please call 503-655-8671. Our appraisal staff will be available to discuss your concerns.

If you disagree with the values on your tax statement, you can file an appeal with the Board of Property Tax Appeals by Tuesday, Jan. 2, 2024.

You can contact the County Clerk’s office at 503-655-8662 for more information.

Appeal forms are available online. Appeal forms must be postmarked or delivered to the Clerk’s office on or before 1/2/2024.

Join Our Town Hall

There will be one virtual Town Hall this year hosted by Assessor Bronson Rueda. Join our virtual town hall on Wednesday, Nov. 1 from 6 p.m. to 8 p.m.

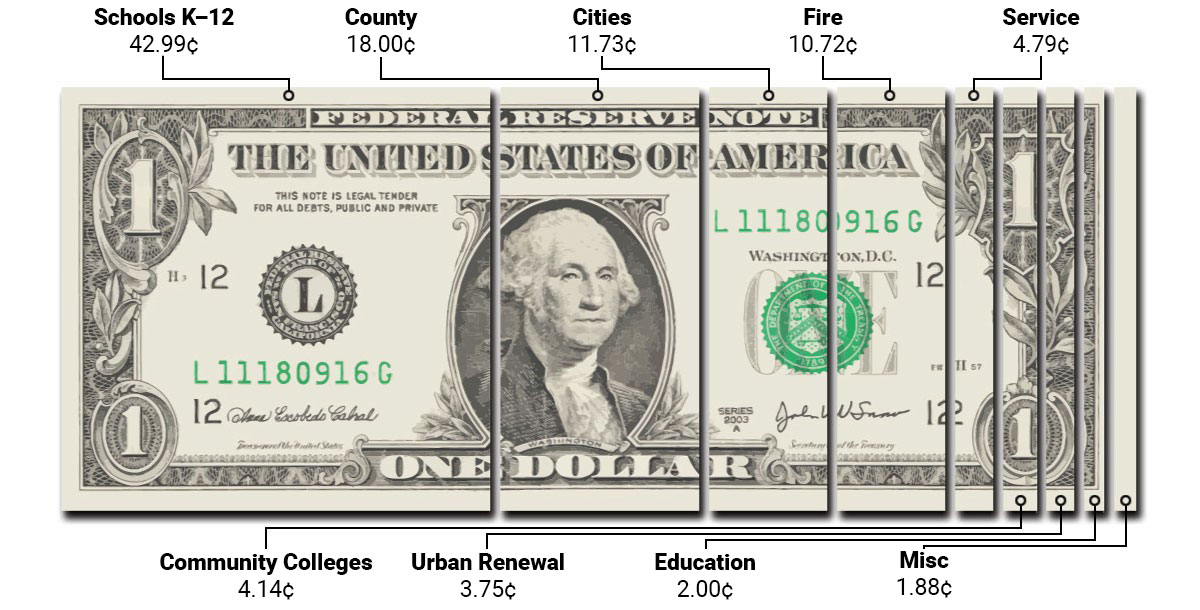

Property Taxes Support Your Local Services1

Property taxes in Clackamas County support 133 local government taxing districts, including 18 school districts, 16 cities, 13 fire districts, and the county. Other taxing districts providing services include water districts, public safety districts, the Port of Portland, and Metro.

1 Based on data from 2022

2 Service includes Library, Metro, Extension Office, and Sewer

3 Misc includes Port, Vector, Cemetery, Water, Parks, and Lighting

New Voter Approved Money Measures

| District | Rate | Contact |

|---|---|---|

| New Local Options | Actual | |

| Clackamas Fire #1 | $0.52/$1,000 | Mark Whitaker mark.whitaker@clackamasfire.com 503-742-2600 |

| Monitor Fire District | $0.50/$1,000 | John Vandecoevering johnvan@monitorcoop.com 503-951-3213 |

| Sherwood School District | $1.50/$1,000 | Gary Bennett gbennett@sherwood.k12.or.us 503-825-5040 |

| Local Option Increase | Actual | |

| Canby Fire District | $0.50/$1,000 | Lori Fawcett lfawcett@canbyfire.org 503-266-5851 |

| New Bond | Actual | |

| City of Tualatin | $0.29/$1,000 | Don Hudson dhudson@tualatin.gov 503-691-3050 |

Values and Updates

Real Market Value (RMV) in Clackamas County continued to rise for the assessment date of Jan. 1, 2023. Residential markets remained strong and many areas experienced moderate increases with low inventory and short marketing times.

Property taxes in Oregon are based on Assessed Value (AV). AV is determined by the lower amount of RMV or Maximum Assessed Value (MAV). Under Measure 50, MAV routinely grows 3% each year resulting in a typical tax increase of 3%. This will be the outcome for many property owners again this year; however, it won’t be the case for everyone.

Taxes that increase greater than 3% include changes to property such as remodeling, new construction, new voter approved money measures, or a combination of changes.

Rising market values can cause less tax savings under Measure 5, Oregon’s other property tax limitation.

Please visit our website for more information on property taxes.

Yellow or green statement?

A yellow tax statement means your mortgage lender requested your payment information and may be paying your property tax. If you have any questions, call your lender. Keep your statement for your records and do not pay if your lender pays your taxes.

Translate

Translate