The tax expenditure information provided by the Clackamas County Department of Assessment & Taxation is a complete list of exempt properties in Clackamas County as certified on the tax roll. The data information can be downloaded for use by each governmental entity responsible for reporting.

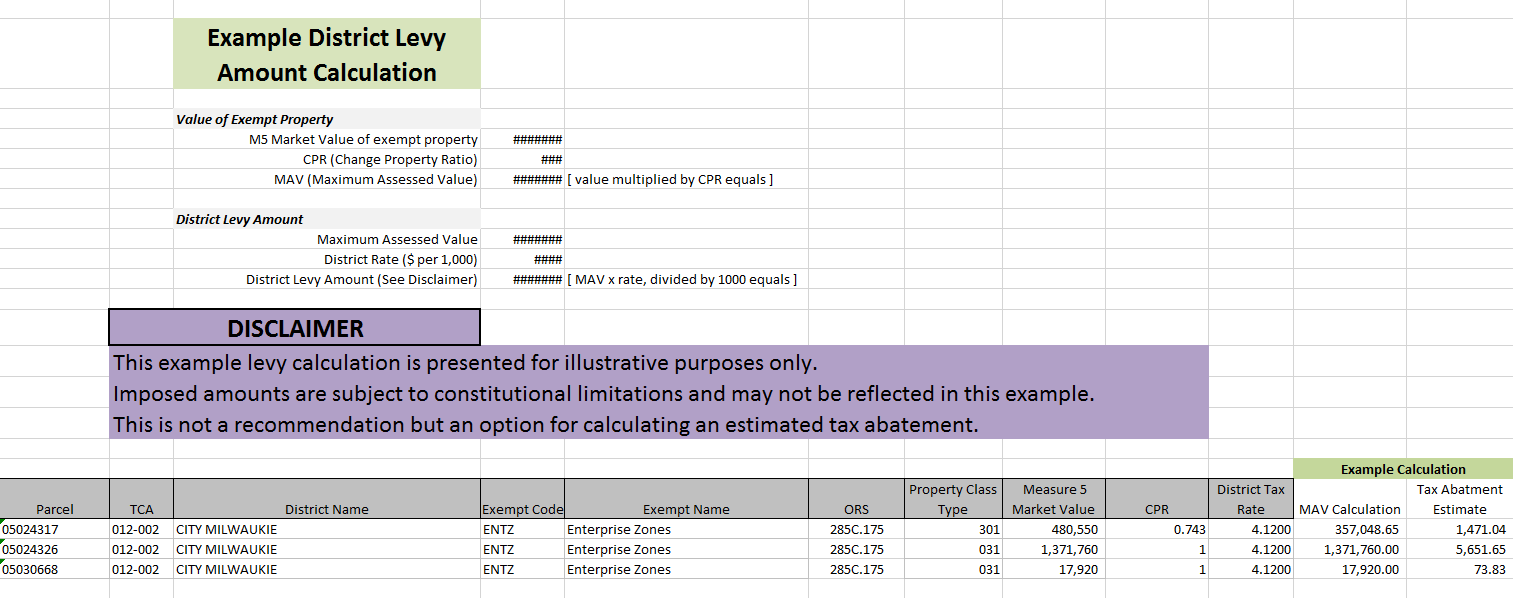

Please refer to GASB 77 for specific disclosure requirements. Each governmental entity is responsible to determine which programs, from the data provided, qualify as abatement programs for their respective entity. The calculation of any associated abatement amounts are an estimate and solely the responsibility of entity management.

Clackamas County Data

Translate

Translate