How to set up your eNoticesOnline.com account

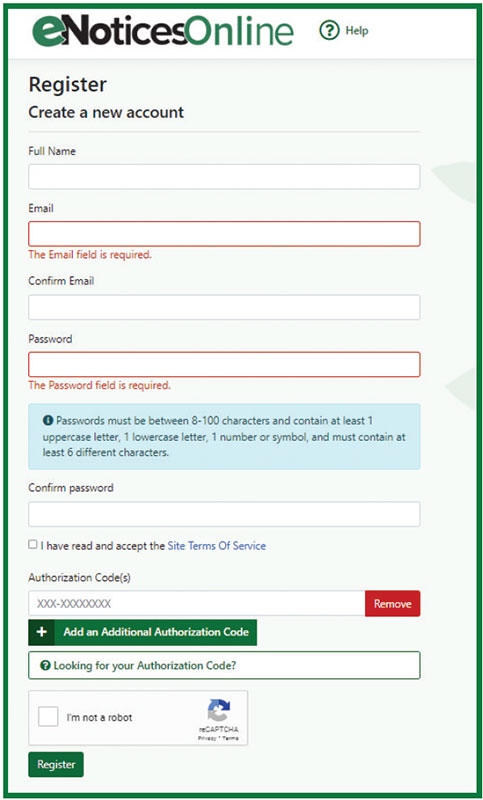

- You will need to locate your “eNoticesOnline.com Authorization Code.” This is located on your latest notice or statement. It will say “eNoticesOnline. com Authorization Code:” followed by your code.

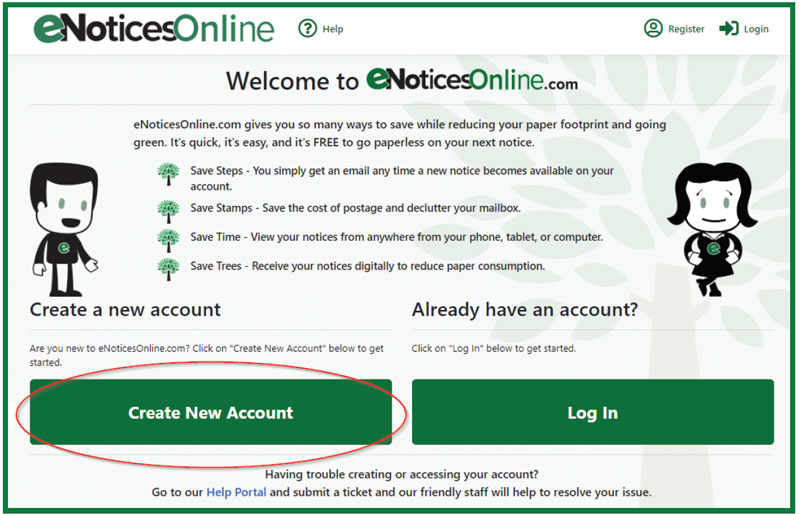

Once you have located it, go to eNoticesOnline.com and click on the “Create New Account” Button.

- In the page that comes up, complete the registration form including the Authorization Code.

Once you submit the form, you should receive an email to the email address you provided during registration.

You MUST click on the “Activate” link in the email message to validate your email address and activate your account. Check your junk/spam email folders if you do not receive activation link within a couple minutes. Also, it is a good idea to add help@enoticesonline.com to your email whitelist or safe senders list.

After activation, you can login online.

- Once activated, you will receive another email indicating you were successful and listing the

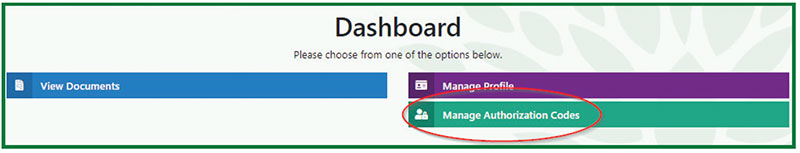

accounts/parcels that you activated. If you have more eNoticesOnline.com Authorization Codes to enter, log into your account and

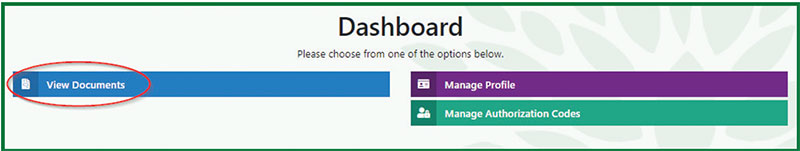

go to “Manage Authorization Codes” and enter any remaining codes you may have. This will

allow you to view all your notices with one eNoticesOnline.com account.Once you have successfully activated your account, log in and click on “View Documents” from

your dashboard to view or pay your notice(s).

Please note: You are registering for paperless notices and statements when you register at eNoticesOnline.com. It will be your responsibility to keep your email address up to date.

If you need further assistance, please go to help.enoticesonline.com

Translate

Translate