Bronson Rueda, Assessor

Phone: 503-655-8671

2025-2026 Property Tax Information

Clackamas County will mail most of the 170,621 property tax statements to real and personal property owners no later than October 25, 2025. Thousands of customers have already signed up for eNotices and will not receive a mailed property tax statement. Instead, they will have online access this year to their property tax statements as soon as October 21, 2025, which is much earlier than those receiving mailed property tax statements. If you want early access to your property tax statement in the future, sign up for eNotices by visiting our website or call our office at 503-655- 8671 for help.

Please mail your payment early or pay online to avoid a late payment and loss of discount.

The U.S. Postal Service (USPS) is implementing the "Delivering for America" plan, which involves consolidating mail processing into new Regional Processing and Distribution Centers. This change will alter the postmark date on what you mail, which will no longer accurately reflect the actual date when your item was sent. Under the new system, mail is collected from local post offices once a day, typically in the morning (note that mailboxes may not reflect these updated pickup times), and transported to a regional center for processing. This means that a letter mailed on a Monday will not be postmarked until Tuesday or Wednesday. This can have severe consequences for time-sensitive documents, such as making tax payments. While much mail is processed and postmarked at large regional centers, mail can also be hand-canceled at smaller post office branches only upon your request.

If you need a piece of mail postmarked with a specific date, like your property tax payment, you should take it to the counter of a local post office and request a hand cancellation. The postal worker will stamp the date on your mail and cancel the stamp by hand. If you are unable to receive a hand cancellation, please mail your property tax payments as early as possible. You can also choose to pay online or in person.

Property tax payments are due November 17, 2025. The due date is typically November 15, but since that date falls on a Saturday this year, the due date is pushed forward to the next business day, November 17, 2025. Clackamas County recognizes that many in our community experience economic challenges every year. Please note, Oregon state law sets the deadline when property tax payments are due and requires that interest be charged on delinquent taxes as of December 16. Clackamas County does not have the statutory authority to extend the payment deadline, nor waive interest charges on late property tax payments.

This year’s total property tax is $1,235,352,377, an increase of 5.02% over last year’s total of $1,176,317,142. Property taxes support 130 local taxing districts in Clackamas County, including 18 school districts, 16 cities, 13 fire districts, and 24 urban renewal plans. Other taxing districts providing services include water, public safety, the Port of Portland, and Metro. Tax code areas on your statement identify the unique mix of taxing districts for your location. There are currently 357 different tax code areas in Clackamas County.

The $59 million increase in property taxes is generated from new construction, voter approved money measures, and the 3% increase in assessed value under Measure 50.

Real market value for 2025 in Clackamas County grew 3.3%. This is slightly higher than the 2024 growth rate of 1.4%, which was an 11 year growth rate low. However, real market value in the county has been trending upward since 2013.

Real market value of all property in Clackamas County, including new construction, totaled $122.98 billion for January 1, 2025, up from $119 billion in 2024. Taxable value grew by 3.9%, from $66.15 billion to $68.74 billion. The average real market value of a single family home is $691,382 and the median value is $595,816. The average taxable value is $370,342, which is equal to about 54% of the average real market value. The values on your tax statement are as of January 1, 2025 and reflect market changes from the prior 12 months. The values do not reflect changes in the real estate market after the assessment date of January 1, 2025.

Typically, property owners see a 3% increase in taxes due to Measure 50’s constitutional limitation of maximum assessed value growth. For the 2025-26 tax year, some areas are below 3% where districts levied less for bonded debt while other areas see taxes greater than 3% due to new voter approved money measures. Approximately 1,530 property owners will see tax increases between 0-2%, 32,200 between 2-3%, while 120,600 will see increases greater than 3% and approximately 16,000 property owners will see taxes reduced.

For the 2025-26 tax year, about 6.0% of all properties in Clackamas County are paying on real market value because it falls below their Measure 50 value, which is similar to last year. Measure 50 limits maximum assessed value growth to 3% annually unless there are changes to the property. The majority of properties had assessed value growth of 3% required by Measure 50. Those with new construction are an exception to the Measure 50 maximum assessed value growth rule, and grew more than 3%.

Under Measure 5’s tax limitation, tax savings have decreased for many property owners throughout Clackamas County over the past several years due to the steady increase in real market value. Measure 5 compression reduces the tax property owners would otherwise pay in the education and local government categories. Measure 5 limitations are higher as market values increase resulting in less savings. The impact to compression in 2024 was $11.4M in Measure 5 tax savings including about 13,000 properties. The impact to compression in 2025 is $12.1M in Measure 5 tax savings including about 12,300 properties. Learn more about Measures 5 and 50.

Typical Property Tax changes for 2025-2026

| Districts | Increase percentage | Comments |

|---|---|---|

| Canby School District | 2.46% | Bond rates down: Canby School, Canby Fire, Clackamas Community College. |

| Centennial School District | 3.96% | Centennial School bond rate down, Mt. Hood Community College new bond. |

| Colton School District | -0.55% | Colton School bond paid off. |

| Estacada School District | ||

| City Estacada | -2.92% | City bond rate up. School bond paid off. |

| Rural Estacada | -5.10% | School bond paid off. |

| Gladstone School District | 1.99% | Bonds down: Gladstone School, Clackamas Community College. |

| Gresham Barlow School District | 4.12% | Mt. Hood Community College new bond. |

| Lake Oswego School District | ||

| City Lake Oswego | 1.98% | Bond rates down: Portland Community College, School Lake Oswego. |

| Rural Lake Oswego | 2.30% | Bond rates down: Portland Community College, School Lake Oswego. |

| City Portland | 2.00% | Bond rates down: Portland Community College, School Lake Oswego. |

| Molalla River School District | ||

| City Molalla | 3.45% | Bond rates up: City Molalla, Fire Molalla |

| Rural | 3.06% | Bond rates up: Fire Molalla |

| Newberg School District | 3.15% | Tualatin Valley Fire local option increase |

| North Clackamas School District | ||

| City Gladstone | 3.17% | Bond rates up: North Clackamas School |

| City Happy Valley | 3.08% | Bond rates up: North Clackamas School |

| City Milwaukie | 3.08% | Bond rates up: North Clackamas School |

| City Portland | 3.07% | Bond rates up: North Clackamas School, City Portland. Bonds down: Clackamas Community College, Clackamas Fire. |

| Rural | 3.15% | Bond rates up: North Clackamas School. |

| Oregon City School District | ||

| Oregon City | 10.53% | New school bonds, increase city rate. |

| Rural | 11.67% | New School bonds. |

| Oregon Trail School District | ||

| City Sandy | 4.44% | New bonds: Mt. Hood Community College |

| Rural | 7.71% | New bonds: Mt. Hood Community College, Hoodland Fire |

| Portland School District | 3.00% | |

| Riverdale School District | 1.00% | School bonds down |

| Sherwood School District | 2.98% | School bonds down |

| Silver Falls School District | 2.05% | Bond rates down: Silver Falls School District, Clackamas Community College. |

| Tigard Tualatin School District | 9.00% | New Tigard Tualatin School District Bonds. |

| West Linn Wilsonville School District | ||

| City West Linn | 2.97% | Bond rates down: Clackamas Community College, Tualatin Valley Fire & Rescue, West Linn Wilsonville School District. |

| Wilsonville | 3.00% | Bond rates down: Clackamas Community College, Tualatin Valley Fire & Rescue, West Linn Wilsonville School District. |

| Rural | 2.51% | Bond rates down: Clackamas Community College, Tualatin Valley Fire & Rescue, West Linn Wilsonville School District. |

Changes in Bond and Local Option Rates Impacting Taxes

| District | Levy Type | Purpose of New Levy | 2024 | 2025 | 2025 Change |

|---|---|---|---|---|---|

| Colton School District | Existing Bond Paid Off | 0.4388 | 0.00 | -0.4388 | |

| Estacada School District | Existing Bond Paid Off | 1.0650 | 0.00 | -1.0650 | |

| City Estacada | Existing Bond |

0.1282 |

0.1858 |

0.0576 | |

| Newberg School District | Existing Bond | 1.4065 | 1.2844 | -0.1221 | |

| Riverdale School District | Existing Bond | 2.5357 | 2.4065 | -0.1292 | |

| North Clackamas School District | Existing Bond | 2.1853 | 2.3256 | 0.1403 | |

| Portland School District | New Bond | Modernize schools and increase health & safety | 2.3338 | 2.4835 | 0.1497 |

| Mt. Hood Community College | New Bond | Update, improve, and repair facilities | NA | 0.2513 | 0.2513 |

| Hoodland Fire District | New Bond | New Public Safety Facility | NA | 0.7925 | 0.7925 |

| Tigard/Tualatin School District | New Bond | Increase safety, repair and modernize facilities | 1.6904 | 2.6797 | 0.9893 |

| Oregon City School District | New Bond | Increase safety, repair and update facilities | 1.1360 | 2.3860 | 1.2500 |

| Molalla Fire District | New Bond | Public Safety | 0.2080 | 0.2724 | 0.0644 |

| Tualatin Valley Fire & Rescue | Local Option | Retain existing first responders | 0.4500 | 0.6900 | 0.2400 |

Location, Office Hours, and Public Services

Clackamas County Department of Assessment & Taxation

150 Beavercreek Road, Suite 135, Oregon City, OR 97045

Lobby/Phone Hours 8 a.m. - 4 p.m., Monday – Thursday

Open Friday, Nov. 14, 8:00 a.m. - 4:00 p.m., for payments only

503-655-8671

Taxpayers can email after hours at PropertyTaxInfo@clackamas.us

NOTE: Access to Clackamas County’s Assessment & Taxation office in the Development Services Building and nearby parking areas on the Red Soils campus may be impacted with the completion of the Clackamas County Courthouse. To avoid delays due to anticipated traffic and parking issues, please consider mailing your payment or using our online payment option this year. Make an online payment.

Extended Lobby Hours November 3 - 6, 10 - 13, and 17, 2025, 7:30 a.m. - 5:00 p.m. The office will be closed Tuesday, Nov. 11 for Veterans Day.

The county offers an option for property tax statements to be delivered electronically through a secure web-based service called eNoticesOnline. Property owners who want to go paperless and/or prefer to receive documents online, rather than printed and mailed, can sign up for the electronic statement service using a unique account registration code printed on their property tax statements. Once an account is registered, electronic statement notices will arrive via a registrant’s email and paper statements will no longer be delivered.

Taxpayers can visit our website to find directions to set up an eNoticesOnline account using their 2025-26 statements, and stay up to date on all Assessment and Taxation information and event.

Our goal is to provide outstanding customer service, offer convenience with payment options, and build public trust through good government.

Join our Virtual Town Hall

Join us on Wednesday, November 5 from 6 p.m. to 8 p.m.

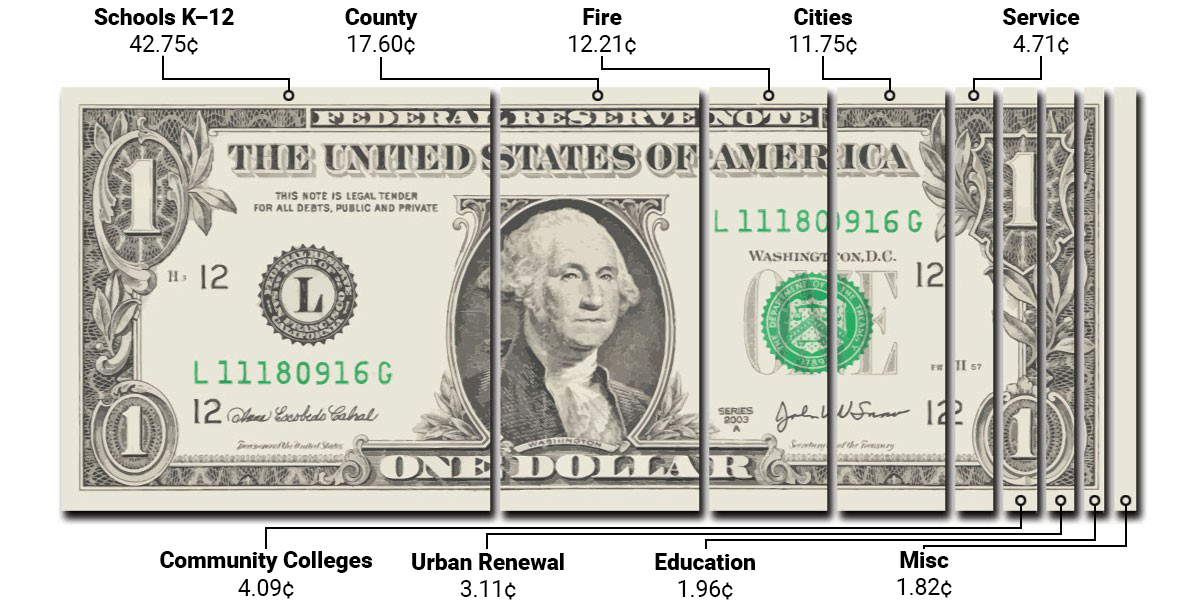

Where Your Tax Dollars Go – Local Services

Property Value Appeals Board (PVAB)

The value change notice is part of the tax statement. If you have questions regarding the values on your tax statement, please call our appraisal staff to discuss your concerns at 503-655-8671. Taxpayers can file value appeals with PVAB through December 31, 2025. PVAB’s phone number is 503-655-8662.

Due Dates and Paying Property Taxes

Full payment of taxes is due by November 17, 2025 to receive the 3% discount. A two percent discount is given if 2/3 payment is received by November 17, 2025. No discount is allowed on a 1/3 payment by November 17, 2025 with additional 1/3 payments due on February 17, 2026 and May 15, 2026.

We encourage people to pay their taxes early and take advantage of the payment methods most convenient for them. Mail payments early to ensure they are received timely. You can also choose the online payment process where e-checks and debit card payments are very affordable (see our website for more information). There is a tax payment drop box located to the left of the main entrance at the Development Services Building. Also, look for signs directing you to our drive through tax payment drop box located off Courthouse Road beginning November 1, 2025.

Important notice for bill payment service users

Please know your bill pay service rules. Payments made with electronic bill pay services must be received in our office by November 17, 2025. Please request payment far enough in advance with your bill pay provider so that we receive your payment timely. Bill pay service payments received after November 17, 2025 will not receive the discount and are subject to interest charges if not received by December 15, 2025.

Translate

Translate