Property taxes are due Nov. 17, 2025

Discounts and payment options available

Ways to Pay

Drop box

- A walk-up payment drop box is located outside our building entrance at 150 Beavercreek Road in Oregon City

- A temporary drive-up drop box will be located in the north parking lot from Nov. 3-17

Online

- Visit our website to pay by credit card, debit card, or e-check (Clackamas County retains no portion of processing fees)

- Payments must be submitted on or before the due date

- Allow sufficient time for bank processing so your funds arrive by Nov. 17

- Bill pay remittance needs to be in our office by the due date if not postmarked

- Mail your check (do not mail cash) using the return envelope and include your payment stub

- Make checks payable to Clackamas County Tax Collector

- Payments must be USPS postmarked by Nov. 17, 2025 with proper postage

- Please mail early to ensure your payment is received timely

- Returned checks will be charged a $25 service fee

In person

- Regular office hours are Monday–Thursday from 8 a.m. to 4 p.m.

- Open Friday, Nov. 14, 2025, from 8 a.m. to 4 p.m. (payments only)

- Check our website for changes to office hours during tax season

Complete payment option details

Discounts and Payment Options

Payments must be submitted on or before the following due dates. Late payments will not be eligible for a discount and may incur interest. Be sure to mail payments early due to any U.S. Postal Service delays.

Option 1: Pay full amount by 11/17/2025 for a 3% discount

Option 2: Pay 2/3 by 11/17/2025 for a 2% discount and the remaining 1/3 by 5/15/2026

Option 3: Pay 1/3 by 11/17/2025, 1/3 by 2/17/2026 and 1/3 by 5/15/2026

Paperless Property Tax Statements Now Available

Clackamas County offers an option for property tax statements to be delivered electronically through a service called eNoticesOnline.

Clackamas County offers an option for property tax statements to be delivered electronically through a service called eNoticesOnline.

Property owners who want to go paperless and/or prefer to receive documents online, rather than printed and mailed, can now sign up for electronic statement service using a unique account registration code printed on their property tax statements.

Once an account is registered, electronic statement notices will arrive via a registrant’s email and paper statements will no longer be delivered.

Sign up for paperless tax statements

Property Value Appeals Board (PVAB)

If you have questions regarding the values on your tax statement, please call 503-655-8671.

Our appraisal staff will be available to discuss your concerns.

If you disagree with the values on your tax statement, you can file an appeal with the Property Value Appeals Board by Wednesday, Dec. 31, 2025.

You can contact the County Clerk’s office at 503-655-8662 for more information.

Appeal forms are available online, and must be postmarked or delivered to the Clerk’s office on or before Dec. 31, 2025.

Understanding Your Tax Statement

- Key property data

- Ownership and mailing address

- Real Market and Assessed (taxable) Property Values (current and prior year)

- Taxing districts

- Education taxes

- General government taxes

- Bond taxes

- A yellow tax statement means your mortgage lender requested your payment information and may be paying your property tax

- Payment options and due dates

- Delinquent taxes

- Total taxes due (after discount)

Join Our Town Hall

There will be one virtual Town Hall this year hosted by Assessor Bronson Rueda. Join our virtual town hall on Wednesday, Nov. 5 from 6 p.m. to 8 p.m.

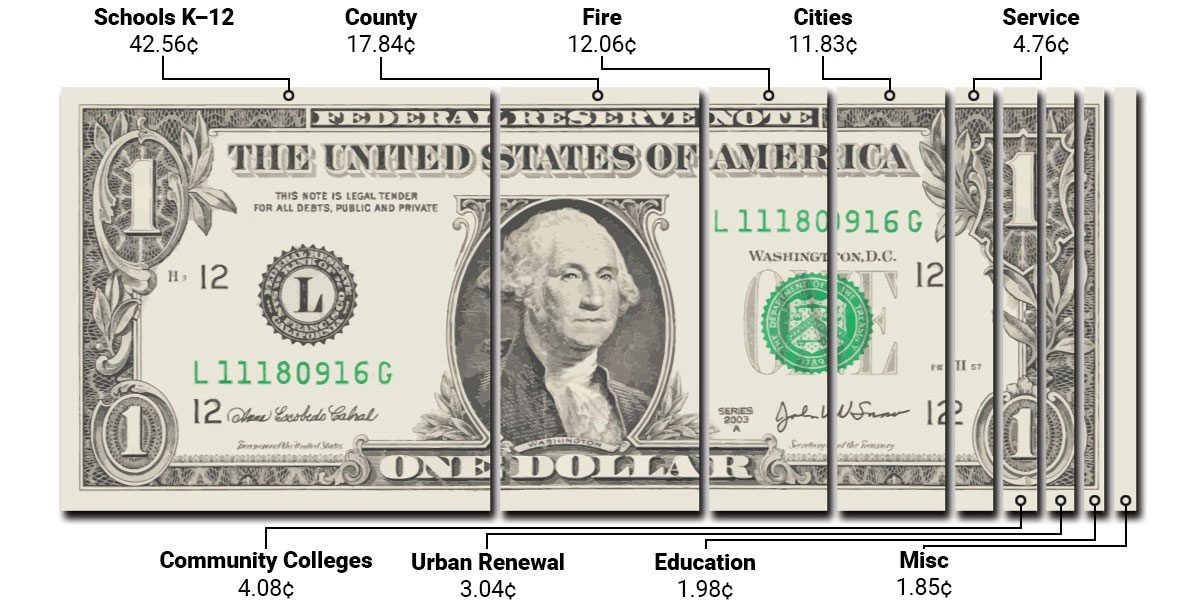

Property Taxes Support Your Local Services1

Property taxes in Clackamas County support 130 local government taxing districts, including 18 school districts, 16 cities, 13 fire districts, and the county. Other taxing districts providing services include water districts, public safety districts, the Port of Portland, and Metro.

1 Based on data from 2024

2 Service includes Library, Metro, Extension Office, and Sewer

3 Misc includes Port, Vector, Cemetery, Water, Parks, and Lighting

New Voter Approved Money Measures

| District | Rate | Contact |

|---|---|---|

| New Bonds | Estimated | |

| Clackamas Community College | $.25/$1,000 | Christina Owen 503-594-3009 christina.owen@clackamas.edu |

| Oregon City School District | Increase $1.20/$1,000 | Blaze Riggins: 503-785-8000 blaze.riggins@orecity.k12.or.us |

| Mt Hood Community College | $.21/$1,000 | Jennifer DeMent 503-491-7385 jennifer.dement@mhcc.edu |

| Portland School District | $2.50/$1,000 | Michelle Morrison 503-916-2000 mimorrison@pps.net |

| Tigard/Tualatin School District | Increase $.99/$1,000 | Jessica Seay 503-431-4016 jseay@ttsd.k12.or.us |

| Hoodland Fire District | $.78/$1,000 | James Price 503-622-3256 jimprice@hoodlandfire.gov |

| Molalla Fire District | $.26/$1,000 | Vince Stafford 503-892-2200 vstafford@molallafire.org |

| Local Option Increase | Actual | |

| Tualatin Valley Fire & Rescue | $.69/$1,000 up from $.45/$1,000 | Valerie Colgrove 503-649-8577 valerie.colgrove@tvfr.com |

Values and Updates

Real Market Value (RMV) in Clackamas County remained relatively stable again with some market areas having slight decreases/increases for the Jan. 1, 2025 assessment date. Both residential marketing time and inventory saw slight increases from the prior year.

Property taxes in Oregon are based on Assessed Value (AV). AV is determined by the lower amount of RMV or Maximum Assessed Value (MAV). Under Measure 50, MAV routinely grows 3% each year resulting in a typical tax increase of 3%. This will be the outcome for many property owners again this year; however, it won’t be the case for everyone.

Taxes that increase greater than 3% include changes to property such as remodeling, new construction, new voter approved money measures, or a combination of changes.

Rising market values can cause less tax savings under Measure 5, Oregon’s other property tax limitation.

Please visit our website for more information on property taxes.

Yellow or green statement?

A yellow tax statement means your mortgage lender requested your payment information and may be paying your property tax. If you have any questions, call your lender. Keep your statement for your records and do not pay if your lender pays your taxes.

Translate

Translate