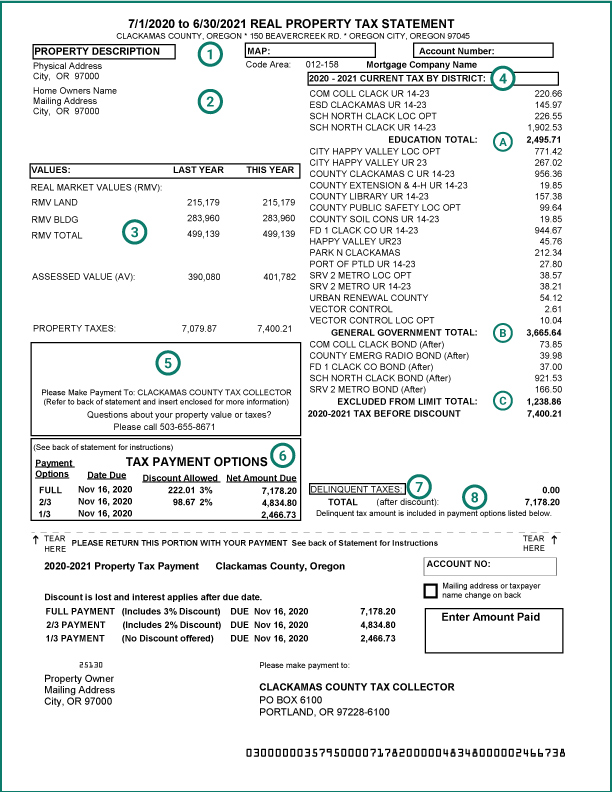

Property Tax Deferral for Disabled and Senior Citizens

State programs may allow you to delay paying property taxes on your residence.

You may qualify for the following deferrals if you are:

| Disabled Citizens' Deferral |

|

| Senior Citizens' Deferral |

|

Additional Requirements

| Net worth | Your net worth limit is $500,000.

|

| Income criteria | For 2026, annual household income during 2025 cannot exceed $70,000. Household income includes the income of all persons living in the home with you. |

| Home occupancy | You must have both owned and lived on the property for at least the last five full years ending April 15. If you lived away from the property due to medical reasons, you must attach a medical statement on letterhead from your healthcare provider stating that you are required to be away for health-related reasons. |

| Homeowner's insurance | You must show proof of homeowner's insurance that covers fire and other casualties. |

| Real Market Value | The real market value (RMV) of your home cannot be more than 100% of the county median RMV, but there are graduated allowances based on additional years of occupancy. |

| Interest | Deferral accounts accrue interest at the rate of 6% yearly. Interest continues to accrue each year on the balance of deferred tax amounts paid by the Department of Revenue. |

| Re-certification | To remain in the program, you must "re-certify" every two years. This means you must re-apply for the program every other year and meet all of the qualifications. If you do not re-certify or qualify, the state will not pay your property taxes. |

For either deferral program, you must have a recorded deed to the property or be buying the property under a recorded sales contract. Certain trust or trustee arrangements qualify for deferral. You would not be eligible for deferral if you have a life estate interest in the property.

Additional Information

Reverse mortgages

House Bill 2587 (2019) allows homes with certain reverse mortgages to qualify for the Senior and Disabled Deferral Program.

You may qualify for deferral if you entered into a reverse mortgage between July 1, 2011, and December 31, 2016, and have equity in your home of at least 40% as of the date of your deferral application. This does not enable retroactive deferral payments for prior tax years but enables deferral to pay the taxes to the county going forward for homes that qualify.

The State records a lien on your property

- The deferred taxes paid by the state become a first lien on your property, except for the liens of mortgages or trust deeds that were recorded first.

- The lien amount is an estimate of future taxes to be paid and interest to be charged, based on life expectancy tables.

- When the Oregon Department of Revenue has approved your application, you must tell your mortgage holder that the state will be paying your taxes.

Paying the deferred taxes

The deferred taxes plus interest have to be paid when any of the following occurs:

- The taxpayer getting the deferral passes away leaving no surviving spouse

- You sell the property or in some way change the ownership

- You cease to permanently live on the property

How to File

You need to file an application with our office between Jan. 1 and April 15 to defer the taxes due the following Nov. 15.

Income verification is required when you file.

If you have questions, or wish to file, you can contact our office at 503-655-8671 and ask for assistance with the Senior Tax Deferral Clerk.

Translate

Translate