Assessment and Taxation

Farm and Forestland Soil Type Value Table

Clackamas County Assessor 2022–23

| Common Descriptive Class | Land Class Designation (Soil ID) |

2022–23 M5SAV | 2022–23 MSAV | 2022–23 SAVL |

|---|---|---|---|---|

| Intensive Capability - Special Soils | 1SR | 10,684 | 2,790 | 2,790 |

| Sandy Loams - Special Soils | 2SR | 10,684 | 2,790 | 2,790 |

| Sandy Loams - No Irrigation | 2SD | 3,055 | 992 | 992 |

| Class I Valley Irrigated | 1VR | 5,437 | 1,813 | 1,813 |

| Class I Valley Dryland | 1VD | 2,865 | 1,323 | 1,323 |

| Class I Hill Irrigated | 1HR | 4,401 | 2,521 | 2,521 |

| Class I Hill Dryland | 1HD | 3,331 | 1,680 | 1,680 |

| Class II Valley Irrigated | 2VR | 4,660 | 1,495 | 1,495 |

| Class II Valley Dryland | 2VD | 2,865 | 992 | 992 |

| Class II Hill Irrigated | 2HR | 3,970 | 931 | 931 |

| Class II Hill Dryland | 2HD | 2,416 | 824 | 824 |

| Class III Valley Irrigated | 3VR | 4,091 | 1,157 | 1,157 |

| Class III Valley Dryland | 3VD | 2,227 | 824 | 824 |

| Class III Hill Dryland | 3HD | 2,416 | 425 | 425 |

| Class V Pasture Dryland | 5PD | 1,225 | 152 | 152 |

| Class VI Pasture Dryland | 6PD | 984 | 115 | 115 |

| Class VII Pasture Dryland | 7PD | 259 | 48 | 48 |

| Farm Pond - No Irrigation | 7PN | 2,500 | 1,875 | 1,875 |

| Farm Woodlot | 7WD | 214 | 168 | 168 |

| Farm Home Site Improvement | FHSI | 4,000 | 6,492 | 4,000 |

| Site 1 Small Tract Forestland Option | SFA | 252 | 157 | 157 |

| Site II | SFB | 200 | 124 | 124 |

| Site III | SFC | 168 | 104 | 104 |

| Site IV | SFD | 143 | 88 | 88 |

| Site V | SFE | 95 | 58 | 58 |

| Site VI | SFF | 69 | 42 | 42 |

| Site VII | SFG | 29 | 17 | 17 |

| Site VIII | SFX | 3 | 2 | 2 |

| Site 1 Forestland (over 5000 acres) | OFA | 1,262 | 789 | 789 |

| Site II (over 5000 acres) | OFB | 999 | 626 | 626 |

| Site III (over 5000 acres) | OFC | 839 | 524 | 524 |

| Site IV (over 5000 acres) | OFD | 715 | 445 | 445 |

| Site V (over 5000 acres) | OFE | 474 | 296 | 296 |

| Site VI (over 5000 acres) | OFF | 343 | 214 | 214 |

| Site VII (over 5000 acres) | OFG | 146 | 89 | 89 |

| Site VIII (over 5000 acres) | OFX | 15 | 10 | 10 |

Veteran's Tax Exemptions

If you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of your property taxes.

For 2025, the basic exemption for a disabled veteran or the surviving spouse or registered domestic partner (partner) of a veteran is $26,303 of Assessed Value. The exemption for a service-connected disability is $31,565 of Assessed Value. The exemption amount increases each year by 3%. This is an average savings in property taxes of approximately $400.

Requirements

- Be a war veteran who is officially certified by the U.S. Department of Veterans Affairs or any branch of the United States armed forces as being 40% or more disabled

or - Be a surviving spouse of a war veteran who has not remarried.

and - You must own and live on the property. Buyers with recorded contracts and life estate holders are considered owners. Temporary absences due to vacation, travel or illness do not disqualify you from the program.

How to File

- You need to file an application with our office by April 1 to secure the exemption for taxes due the following Nov. 15. Once qualified, you do not need to file an annual renewal.

- The exemption is applied to your current residence and is not transferrable. If you move or change the ownership record you will need to file a new application.

- If you are a disabled war veteran, but not certified by the armed forces, you will need to meet an income limit.

| 0 dependents | $29,526 |

| 1 dependent | $40,034 |

| for each additional dependent | + $10,508 |

Applications

If you have questions, or wish to file, you can contact our office at 503-655-8671 and ask for assistance with the Veteran's Tax Exemption

Paying Your Property Tax Bill

You will receive a 3% discount if paying in full by Tuesday, Nov. 15. For questions regarding other payment options please go to Payment Options.

Our business hours are Monday through Thursday from 8 a.m. to 4 p.m. (closed Fridays). Please watch for information in the newspaper, on our website or contact our office if you have questions.

We encourage payment by mail, but also welcome taxpayers who wish to make payments by coming to our office. We have a payment drop box located to the left of the Development Services Building entrance at 150 Beavercreek Road in Oregon City map. There will be a drive-thru payment drop box available from November 1–5 at the Clackamas County Red Soils Campus (see signs directing traffic on Library Court). Your check is your receipt when using the payment drop boxes.

Our cashiers are unable to process credit or debit cards for payment of property taxes. If you wish to pay taxes using a credit or debit card, please go to Online Payment for information and access. You may also use this site to pay taxes with an electronic check. The service provider, U.S. Bank, does charge a fee for processing these payments.

If you receive a yellow tax statement, a lender or the state senior/disabled deferral program notified us and may intend to pay the taxes. If you receive a green tax statement, it means that the property owner is expected to pay the tax.

One insert is enclosed with your tax statement this year. It provides valuable information about the current tax year, including a town hall schedule. The back of your tax statement provides payment instructions, and you can read more at Payment Options

Other property tax information

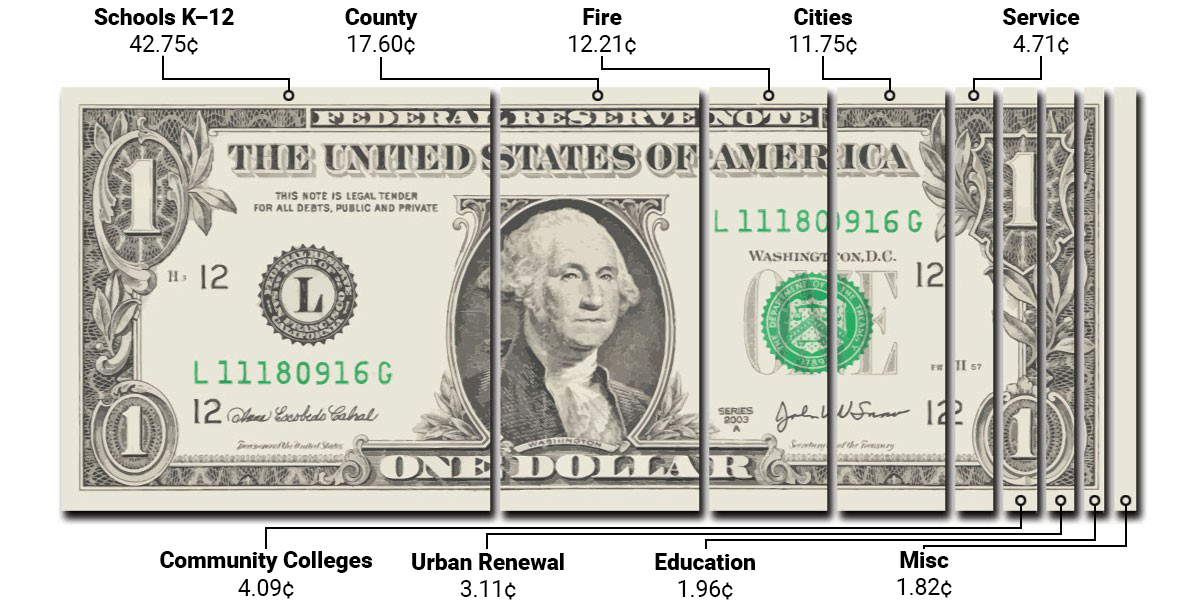

Where Your Tax Dollars Go

Property taxes support your local services

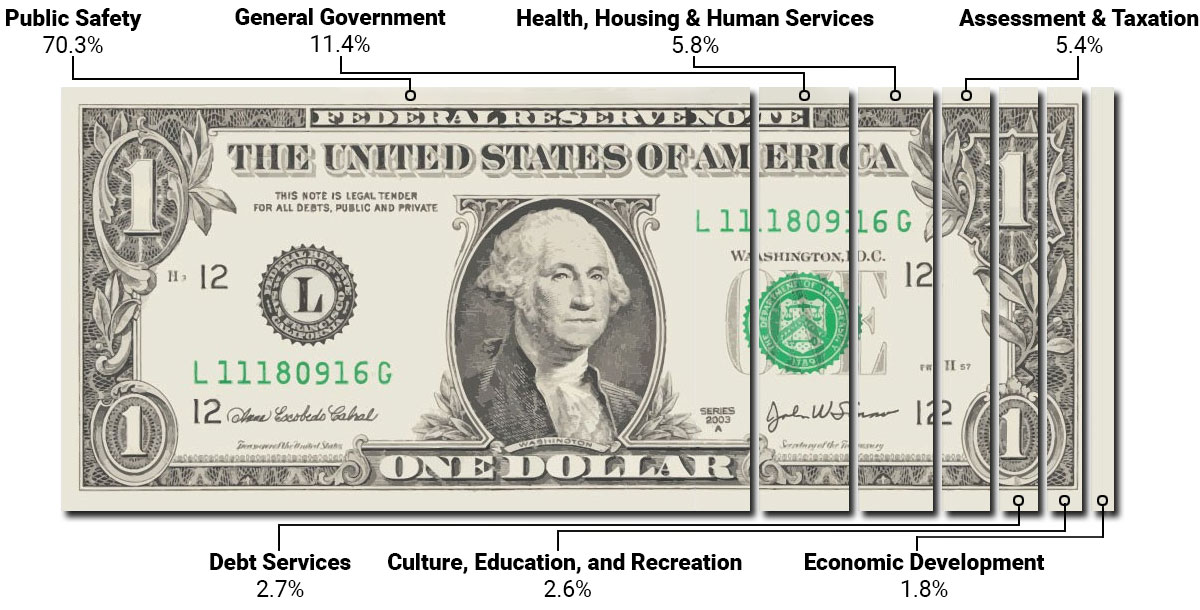

How county tax dollars are spent

GASB 77 Tax Abatement Information

The tax expenditure information provided by the Clackamas County Department of Assessment & Taxation is a complete list of exempt properties in Clackamas County as certified on the tax roll. The data information can be downloaded for use by each governmental entity responsible for reporting.

Please refer to GASB 77 for specific disclosure requirements. Each governmental entity is responsible to determine which programs, from the data provided, qualify as abatement programs for their respective entity. The calculation of any associated abatement amounts are an estimate and solely the responsibility of entity management.

Clackamas County Data

Helpful Information

Assessment & Tax Roll Summaries

Tax District Certified Tax

Education

General Government

Urban Renewal Plans

County North Clackamas Revitalization

City of Canby

City of Estacada

City of Gladstone

City of Happy Valley

City of Lake Oswego East End

City of Lake Oswego Lake Grove

City of Milwaukie

City of Molalla

City of Oregon City

City of Portland

City of Portland Cully

City of Portland 82nd Ave

City of Portland Lloyd-Holliday

City of Portland C Eastside

City of Portland SPACC

City of Portland Westside

City of Portland East 205

City of Sandy

City of Tualatin Basalt Creek

City of Tualatin Core

City of West Linn

City of Wilsonville

City of Wilsonville Coffee Creek

City of Wilsonville West Side

City of Wilsonville Twist

Summary of Property Tax

Statement of Taxes Levied

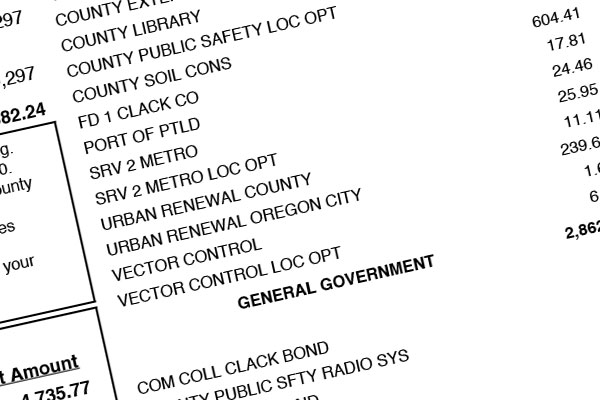

Where Your Tax Dollar Goes

Tax History

Local School Levies

Local Government Levies

Special Taxes Levied

Public Utilities

Highest Tax Due Values in Clackamas County

Tax District Rate Information

List of Taxing Districts by Name

Tax District Rates

Tax code rate detail

Tax code rate totals

Recap of Incorporated Areas

Tax District Value Information

Value Summary

Value History

Assessed Value by Property Type

Measure 5 Market Value by Property Type

Market Value by Property Type

District Ratio of Assessed Value to Measure 5 Value

Commercial/Residential Property Values

Changed Property Ratio History

Farm and Forestland Soil Type Value Table

Frequently Asked Questions

Here you will the find answers to some of our most commonly asked questions.

Business Personal Property

If you’ve filed a return through eNoticesOnline, you will not receive a paper tax statement in the mail. Your tax statement will be available on the eNoticesOnline website, or you can follow the “Property Tax Statements” link below.

Learn how to secure electronic access to your asset lists and tax statements, as well as the ability to file your returns electronically.

Distinguishing between Real Property and Business Personal Property doesn’t need to be complicated.

Search tax statements by year.

Frequently Asked Questions

Questions? Contact our office at 503-655-8671 and ask for assistance with Business Personal Property.

Download an Information Circular about Business Personal Property Tax or a Personal Property Return from the State.

Selling, Moving or Demolishing a Manufactured Home

Ownership Transfers

Ownership Transfers are processed by the State Department of Consumer and Business Services Building Codes Division (BCD) or through a title company. The new process changes the ownership and location of a home in the State records. Simply signing off on an ownership document or sales agreement does not transfer ownership.

Records in the Assessor's office will be updated only after we receive notice from BCD that a transfer has been completed. Until the transfer is complete, our records will show the selling party as responsible for all property taxes.

Selling a Manufactured Home

To complete the process, you will need to do the following:

- Pay all property taxes, interest and fees due, as well as an estimated tax for the current fiscal year at the time of the transfer. All tax payments must be secured with certified funds, cash or cashier's check — no personal checks will be accepted for this process.

- Fill out a Manufactured Home Ownership Document Application for New and Used Homes. The Assessor's Office will confirm that the taxes are paid in full and issue a tax certification. There is a $25 fee to process this form, which can be paid with cash or check. Bring or mail the form with your payment to our office at 150 Beavercreek Road in Oregon City, OR 97045. The form will be returned to you and must accompany any forms submitted to BCD.

- Provide the current DMV title or BCD ownership document signed off by the seller(s) and any lien holder(s).

- Send all forms with payment of $55 for the transfer fee to the address shown on the BCD forms.

You may call us at 503-655-8671 for more information or contact BCD at 503-378-4530 or 503-373-1249 or on their website.

Moving a Manufactured Home

- Secure a placement permit from your local Planning Department to be sure that the manufactured structure may be sited at the new location.

- To obtain a trip permit for a home moving out of Clackamas County, all taxes for the current fiscal year must be paid. You will need to complete and supply our office with the Manufactured Home Ownership Document Application for New and Used Homes. You will need a county Tax Certification form for the county where the home is moving from and obtain a form for the county the home is moving to. Clackamas County charges a $25 fee for this form.

- Send the Manufactured Home Ownership Document Application for New and Used Homes form and county Tax Certification, along with a payment for the $55 transaction fee and trip permit fee (each section requires a $5 trip permit), payable to Oregon Department of Building codes, to the address listed on the BCD form.

- In October, you will receive a tax bill from the county where the manufactured home was located as of January 1 that year.

Exempting a Manufactured Home from Ownership Document

Your DMV title or Ownership Document may be eligible for the exemption process if the ownership of your land and manufactured home are the same. This exemption means that the structure is recorded as part of the land account and is considered real property for all purposes. For more details on how to complete this process, please contact us at 503-655-8671 or BCD at 503-378-4530 or 503-373-1249. You may also contact any Title Insurance company.

Demolishing a Manufactured Home

- Pay all property taxes, interest and fees currently due.

- File a Manufactured Home Ownership Document Application for New and Used Homes form with the Assessor's office (there is no processing fee) and submit the current title or ownership document.

- One of our appraisers will verify the home no longer exists for the applicable tax year. We will notify BCD that the home has been demolished.

Translate

Translate